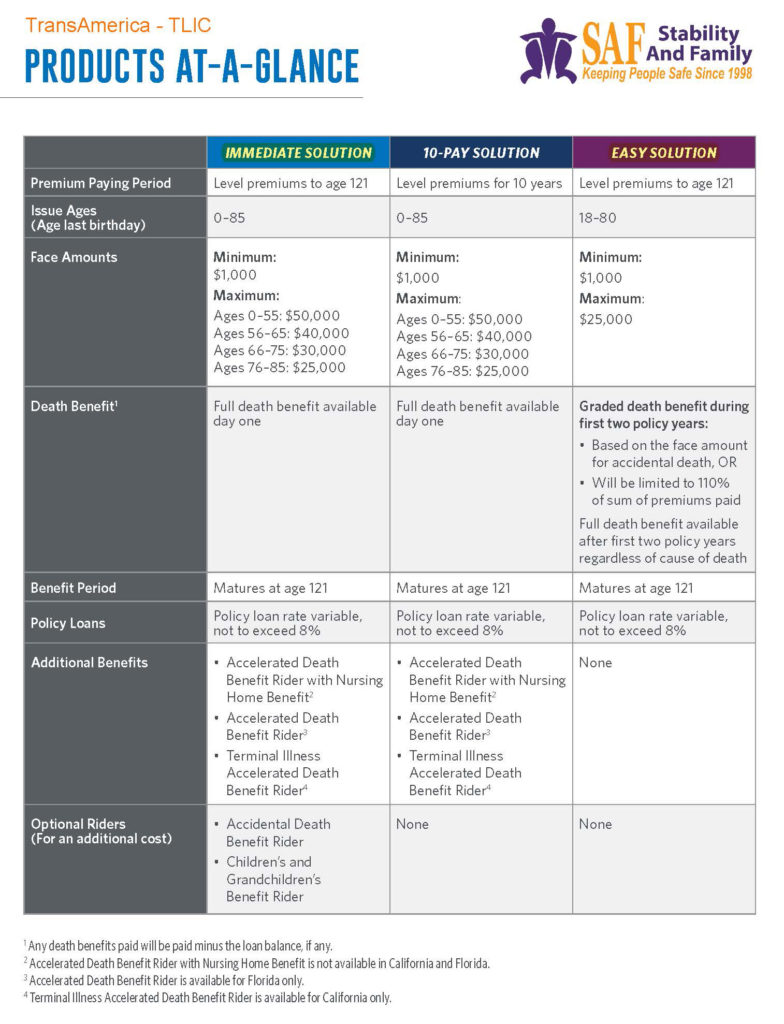

INCLUDES: BOTH Product Rate and Underwriting Guide

*Anemia — Graded possibly Standard.

*Asthma (Chronic) — Standard possibly Preferred.

*Bronchitis (Chronic) — Standard possibly Preferred.

*Heart Disease — Preferred.

*Heart Failure (Congestive or Diastolic) — Standard.

*Hospitalization (within 12 months) — Standard possibly Preferred.

*Liver Disease or Cirrhosis— Standard.

*Respiratory Disease (Black Lung, COPD or Emphysema) — Standard possibly Preferred.

*Supplemental Oxygen Use — Standard possibly Preferred.

* Stroke or Transient Ischemic Attack (TIA) — Standard possibly Preferred.

Helping to provide security for SAF Family’s future now with this TLIC – FE Solutions Brochure.

At death, an Issued TLIC – FE Solutions iGo e-App may provide a cash benefit that may be used to:

- pay off the mortgage,

- provide for your children’s education,

- deliver additional income for your spouse, or

- help with any other final needs.

This death benefit passes federal income tax-free to their beneficiaries. Supplemental benefits and riders may extend their coverage to include illness and other disability benefits. See below for details.

Additional FREE Benefits INCLUDED in this

Solutions Portfolio

CONFINED CARE -

Accelerated Death Benefit Rider

With this benefit, if they are confined to a nursing home at least 30 days after the policy is issued they may receive a monthly benefit of 2.5% of the face amount up to $5,000 monthly.

Confined Care - Disclosure Statement

CHRONIC ILLNESS - Accelerated Death Benefit Rider

With this benefit, SAF Clients can accelerate a portion of your death benefit early if an authorized physician certifies that they are permanently unable to perform at least two activities of daily living (ADL’s). Activities may include eating, toileting, transferring, bathing, dressing, and continence.

Chronic Illness - Disclosure Statement

TERMINAL ILLNESS - Accelerated Death Benefit Rider

With this benefit, the Company may provide up to 100% of the death benefit if the insured is diagnosed by an authorized physician as terminally ill where life expectancy is 24 months or less (some states 12 months).

Customize Their Plan By Selecting Some Of The Following Optional Riders To Add!!

Accidental Death Benefit Agreement

Should your death occur as the result of an accident, this may provide an additional benefit amount to your beneficiary.

Return of Premium Death Benefit Plan

The Return of Premium benefit provides cash values within the first few policy years. Should the policy terminate early, the Owner is entitled to a partial surrender once the cash values begin. The percentage of premium payments returned increases yearly after the second year until it reaches 75% at the end of the level premium paying period that was selected.

CRITICAL ILLNESS - Accelerated

Living Benefits Rider

Their need for additional cash may be great if they are diagnosed with a critical illness. Lost income and medical expenses could take a toll on their family budget.

The CRITICAL ILLNESS (CIR) Accelerated Living Benefit Rider may provide a lump sum payment if you are diagnosed with one of the required covered illnesses.

The benefit may be purchased in a 100%, 50%, or 25% acceleration of the base policy face amount, up to $100,000.

See rider for complete list of covered illnesses.

- Heart Attack

- Stroke

- Cancer

- Blindness

- Terminal Illness

- Kidney Failure

- Paralysis

- Major Organ Transplant

- Coronary Artery Bypass Graft (10%)

-

HIV contracted performing duties

as professional healthcare worker

Children's Insurance Agreement

This benefit provides up to $15,000 of term insurance coverage for each child. Coverage is provided to age 25 and then may be converted into a whole life or endowment plan of insurance offered by the Company at that time for up to five times the initial rider amount without evidence of insurability.

Total Disability Benefit Rider

This benefit provides income protection during periods of total disability. If elected, it may provide a monthly benefit up to $1,500 for a maximum benefit period of two years.

Accident Only Total Disability Benefit Rider

This benefit provides income protection during periods of total disability due to accident. If elected, it provides a monthly benefit up to $2,000 for a maximum benefit period of two years. This benefit has the hard-working American in mind and is available for self‑employed individuals.

Waiver Of Premium Disability Agreement

The Company will waive your premiums if they become permanently and totally disabled. With this extra protection, they are able to keep their valuable coverage during a disability.

Waiver Of Premium For Unemployment Rider

The Company may waive their premiums for the base coverage and all riders for up to six (6) months should they become unemployed for a period of four (4) consecutive weeks after waiting period is satisfied.

Level Term Insurance Rider (SPOUSE)

The Level Term Insurance Rider provides level term insurance coverage on their spouse. The maximum amount of coverage allowed under this rider is up to the amount of base coverage.