INCLUDES: BOTH Impairment Guide and Prescription Reference Guide

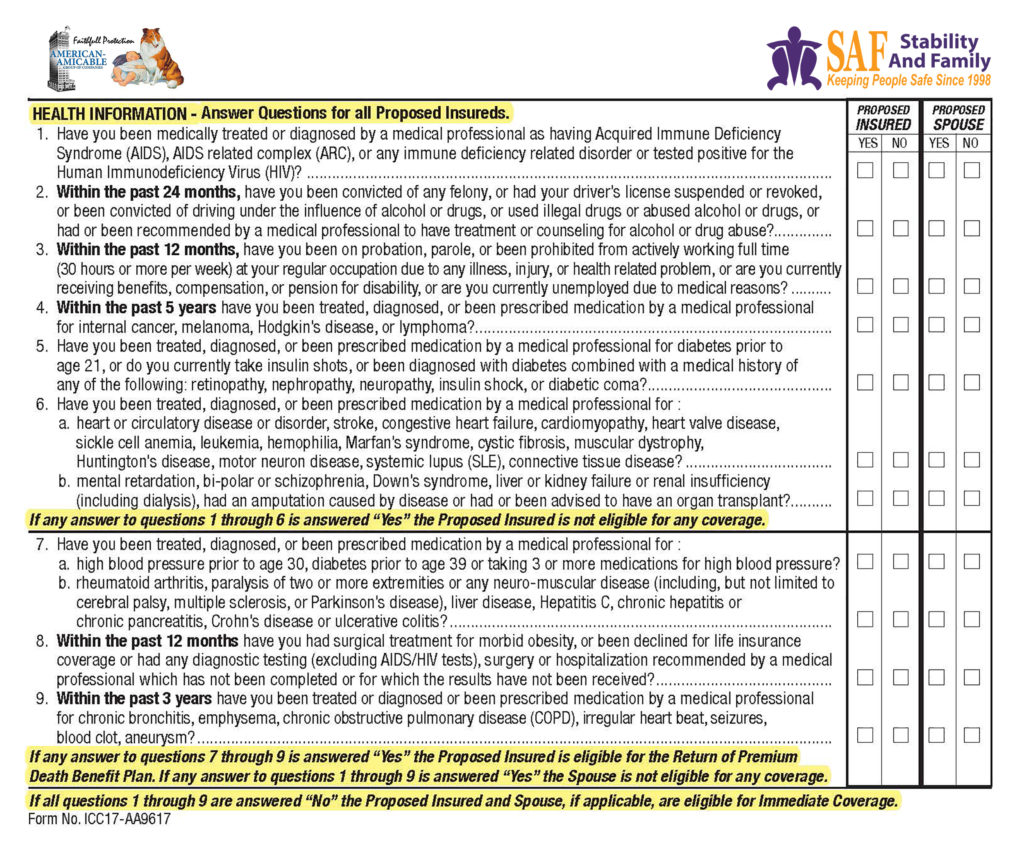

*High Blood Pressure — If diagnosed, treated, or taken medication for prior to age 30 or if taking 3 or more medications for the condition, client should apply for the Return of Premium Plan. Otherwise client should apply for the Immediate Death Benefit Plan..

#Diabetes — Medically diagnosed, treated, or taken medication for prior to 21; Currently taking Insulin shots; Combined with Retinopathy, Nephropathy Neuropathy, Insulin Shock or Diabetic Coma = No Coverage — Medically diagnosed, treated, or taken medication for prior to 39, and Over 21 = Return of Premium.

Helping to provide security for SAF Family’s future now with this Family Choice Brochure.

At death, an Issued Family Choice Application may provide a cash benefit that may be used to:

- pay Funeral, Burial, Memorial, Cremation,

- make Mortgage payments as needed,

- or help with any other financial needs.

This death benefit passes federal income tax-free to their beneficiaries. Supplemental benefits and riders may extend their coverage to include Accidental Death Benefits, Waiver of Premium Disability Agreement, Coverage for their Spouse and Children’s Insurance Coverage… See below for details.

Additional FREE Benefits INCLUDED in this

SafeCare Term

CONFINED CARE -

Accelerated Death Benefits Rider

With this benefit, if you are permanently confined to a nursing home, at least 30 days after the policy is issued, you may receive a monthly benefit equal to 5.0% of the face amount per month. This rider is available on the Immediate Death Benefit plan only

(not available in all states).

Confined Care - DISCLOSURE Statement

TERMINAL ILLNESS - Accelerated Death Benefit Rider

You may receive a death benefit payment of up to 100% of your Family Choice policy if diagnosed as terminally ill where life

expectancy is 12 months or less, 24 months in some states.

Terminal Illness - DISCLOSURE Statement

Customize Their Plan By Selecting Some Of The Following Optional Riders To Add!!

Accidental Death Benefit Agreement

Should their death occur as the result of an accident, the Accidental Death Benefit Agreement provides an additional benefit amount to their beneficiary.Available up to age 80 and benefit remains in effect until age 100.

(not available on ROP plan)

Waiver of Premium Disability Agreement

When you select the Waiver of Premium Disability Agreement, the Company will waive your monthly premiums if you become permanently and totally disabled. With this extra protection, you can keep your valuable coverage during a disability. See rider for complete details. (not available on ROP Plan)

Coverage For Your Spouse

The Level Term Insurance Rider provides level term insurance coverage on your spouse. The maximum amount of coverage which can be applied for under this rider is up to the amount of base coverage.

Children’s Insurance Agreement

The Children’s Insurance Agreement provides up to $9,000 of additional insurance coverage for each child. Coverage is provided to age 25 and then may be converted into any plan of whole life or endowment insurance offered by the Company for up to five times the initial rider amount without evidence of insurability. (not available on ROP)

Consider all the facts, then make your own decision.

The American-Amicable Group of Companies, which includes American-Amicable Life Insurance Company of Texas, Occidental Life Insurance Company of North Carolina, Pioneer American Insurance Company, Pioneer Security Life Insurance Company, and iA American Life Insurance Company, offers term life insurance products with different product features, benefits, and charges; including different term durations, issue ages, guaranteed premium periods, and underwriting classifications. For all the details about the dynamic SafeCare Term from the American-Amicable Group of Companies, contact your licensed sales representative today, e-mail us at contactus@aatx.com, or visit us at www.aatx.com.

Of course, as with the selection of any life insurance policy, you must carefully consider your own financial situation and the many alternatives available to you. No single life insurance product design may have all the features you find desirable. Therefore, it is important to understand the features available so that you can make the best decision for you and your family.

“Family Choice represents a commitment on our part to help provide security

and assurance at a time in your life when you need it the most.”

Joe Dunlap, President

American-Amicable Group of Companies